When choosing a brokerage firm, customer service is an often overlooked, yet critical, aspect of the experience. Both Charles Schwab and Fidelity have earned reputations for providing excellent customer support, but there are some differences worth noting. Charles Schwab’s Customer Service Charles Schwab is known for its top-tier customer service, offering 24/7 phone support, live chat, and email support. Schwab’s representatives are well-trained to assist with a variety of issues, from technical problems to financial advice. In addition to this, Schwab offers in-person consultations at its many branch locations. Schwab Live Chat: Schwab’s live chat feature is available to all customers, providing immediate support for inquiries. This option is often praised for its responsiveness and ease of use. Certified Financial Planners: Schwab offers access to certified financial planners who can provide personalized advice on retirement planning, investment strategies, and other financial matters. Fidelity’s Customer Service Fidelity also offers 24/7 customer support, available via phone, chat, or email. Fidelity’s representatives are known for being knowledgeable and responsive, assisting with everything from account management to trading questions. Fidelity’s Live Chat feature is popular among clients who want immediate help with simple inquiries. Branch Locations: Fidelity has branch offices where clients can meet with representatives in person, providing the added benefit of face-to-face consultations for complex financial matters. Pros and Cons of Customer Service Schwab Pros: Fidelity Pros: Cons for Both: Conclusion Both Charles Schwab and Fidelity provide outstanding customer service. Whether you prefer to contact support online or visit a branch in person, both companies ensure that your questions are answered promptly and accurately. The choice between the two will ultimately depend on your preference for customer interaction.

Fidelity’s Retirement Plans: An In-Depth Review

Fidelity is known for its excellent retirement planning services. Whether you’re looking to open an individual retirement account (IRA) or are managing a 401(k) plan, Fidelity offers a comprehensive suite of retirement options designed to help you meet your long-term goals. Retirement Account Options Fidelity provides a wide range of retirement accounts, including Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. These accounts come with low or no fees, making them an attractive option for those looking to minimize their retirement account expenses. Fidelity IRAs: Fidelity’s IRAs offer access to a broad selection of investments, including stocks, bonds, ETFs, and mutual funds. With no fees for opening or maintaining an IRA and no minimum investment required, Fidelity makes it easy for investors to start saving for retirement. Fidelity 401(k) Plans: Fidelity’s 401(k) options are available to both individuals and employers, offering a wide array of investment choices, low fees, and personalized retirement planning services. Fidelity also offers automated rebalancing to help investors stay on track with their retirement goals. Retirement Planning Tools Fidelity’s retirement planning tools are among the best in the industry. The Retirement Score tool helps you assess whether you’re on track to meet your retirement goals by analyzing your savings, expenses, and other factors. Fidelity also provides access to retirement professionals who can offer personalized advice. Fidelity’s Retirement Income Planner is another great tool, helping users plan for a steady income stream once they retire. This tool allows users to estimate how much they’ll need to withdraw from their accounts and create a sustainable income strategy. Pros and Cons of Fidelity’s Retirement Plans Pros: Cons: Conclusion Fidelity offers an outstanding array of retirement options for both individuals and businesses. Its retirement tools and resources are perfect for anyone looking to build wealth over time, and its low fees ensure that your money is working for you, not being eaten up by unnecessary expenses.

Charles Schwab’s Retirement Plans: A Comprehensive Review

Charles Schwab offers an impressive array of retirement planning tools, making it a strong choice for investors who want to save for retirement in a tax-advantaged manner. Whether you’re just starting to plan for retirement or are looking to optimize your existing retirement portfolio, Schwab has options to suit your needs. Retirement Account Options Schwab offers several retirement account types, including Traditional IRAs, Roth IRAs, and SEP IRAs. Each of these accounts comes with no annual maintenance fees, which helps reduce the overall cost of saving for retirement. Schwab IRAs: Schwab’s Traditional and Roth IRAs are designed to cater to a variety of retirement goals. Schwab offers access to a wide range of investments, including individual stocks, bonds, ETFs, and mutual funds. With no account maintenance fees and a $0 minimum to open an IRA, Schwab makes it easy to get started. Schwab 401(k) Plans: Schwab offers a range of 401(k) plans for small businesses and self-employed individuals. These plans come with low fees and provide participants with a robust suite of investment options. Schwab also offers a dedicated team of retirement specialists to assist employers in managing their plans. Retirement Planning Tools Schwab’s retirement planning tools are incredibly helpful for those looking to forecast their retirement needs. Schwab’s Retirement Planning Calculator lets users estimate how much they need to save each month to reach their retirement goals. The platform also offers retirement planning services, including access to certified financial planners who can provide personalized advice. Pros and Cons of Schwab’s Retirement Plans Pros: Cons: Conclusion Charles Schwab’s retirement plans are well-structured, low-cost options for anyone looking to save for retirement. With the ability to manage all aspects of your retirement accounts through one platform, Schwab makes it easy to plan and save effectively.

In-Depth Review: Fidelity’s Investment Tools

Fidelity is widely recognized for providing exceptional tools and resources that cater to both beginner investors and active traders. Their commitment to creating an intuitive and comprehensive platform has made them a popular choice for those looking to take charge of their investments. Investment Tools Overview Fidelity’s Active Trader Pro platform is its flagship tool for investors. This highly customizable platform is packed with powerful features like real-time market data, advanced charting, and technical analysis tools. Traders can create customized workspaces that display information most relevant to their strategies, making it a versatile option for active traders. Fidelity Mobile App: The mobile app offers the same robust functionality as the desktop platform, allowing users to manage their accounts, place trades, and access research on the go. The app is highly rated for its user interface and ease of use, making it a great option for busy traders. Research and Educational Resources Fidelity’s research offerings are extensive. They provide in-depth analysis from respected sources like Standard & Poor’s and Morningstar, alongside their own proprietary research. In addition, they offer fundamental and technical research on stocks, bonds, mutual funds, and ETFs. For investors looking to build their knowledge, Fidelity’s educational content is rich with tutorials, articles, and webinars that cover a wide range of topics. Whether you’re a beginner or an advanced investor, Fidelity ensures that you have the resources you need to make informed decisions. Pros and Cons of Fidelity’s Investment Tools Pros: Cons: Conclusion Fidelity’s investment tools are well-designed for both casual and serious traders. With its powerful trading platform, strong research resources, and excellent mobile app, Fidelity provides everything an investor needs to succeed in today’s market.

In-Depth Review: Charles Schwab’s Investment Tools

Charles Schwab has long been recognized as a leader in the financial services industry, offering investors a wide array of tools and resources to help manage their investments. Whether you’re a beginner or an experienced trader, Schwab’s tools cater to all levels of investors. Investment Tools Overview Charles Schwab provides a robust suite of investment tools that allow users to manage their portfolios, execute trades, and access important research. Their trading platform, StreetSmart Edge, is one of the most notable tools, providing advanced charting features and real-time data to aid investors in making informed decisions. StreetSmart Edge: This customizable platform is designed for active traders who want to dive deep into data. It offers advanced charting options, technical analysis, backtesting capabilities, and the ability to set up multiple watchlists. For users looking to monitor their investments in real-time, the platform provides a detailed view of the market with streaming quotes and news updates. Schwab Mobile App: Schwab’s mobile app is another vital tool for investors. It allows users to manage their accounts, track performance, and place trades from anywhere. The app features a streamlined interface, offering both simple navigation for beginners and advanced tools for experienced traders. Research and Educational Resources Schwab’s investment tools extend beyond just trading platforms. The company offers a wealth of research and educational resources that help investors at all stages of their journey. Schwab’s research offerings include reports from third-party providers like Morningstar, as well as in-house market analysis. The site also offers webinars, articles, and tutorials designed to help new investors build their knowledge. Pros and Cons of Schwab’s Investment Tools Pros: Cons: Conclusion Schwab’s investment tools are well-suited for both novice and experienced investors. The wide range of resources and features ensures that investors can stay informed, make smarter trades, and continuously improve their skills.

Customer Experience: Charles Schwab vs. Fidelity

When choosing a brokerage, the customer experience should be a key consideration. How do Charles Schwab and Fidelity compare when it comes to support, ease of use, and account management? Ease of Use Schwab’s online platform is known for being extremely user-friendly, with an intuitive interface and streamlined navigation. Whether you’re a beginner or an experienced investor, Schwab’s website and app are designed to make managing your portfolio simple. Fidelity’s platform is also easy to use, with a modern design and a clean interface. Fidelity’s app, in particular, is known for being highly rated, with easy navigation and real-time data. The company also offers a helpful “dashboard” that lets you see all of your accounts in one place. Customer Support Both Schwab and Fidelity provide outstanding customer support. Schwab offers 24/7 phone support, live chat, and in-branch consultations, ensuring that clients can always get help when needed. Fidelity also offers 24/7 phone support, and their website has an extensive knowledge base to help users find answers quickly. Additional Features Schwab offers a wide variety of features to enhance the customer experience, including a highly regarded mobile app and an educational hub. Fidelity excels with its comprehensive retirement planning tools and wealth management services. Conclusion Both Schwab and Fidelity offer strong customer experiences, but Schwab may be the better choice for investors seeking a more personalized experience. Fidelity shines with its extensive wealth management services and retirement planning tools.

Which is Better for Retirement Planning? Charles Schwab or Fidelity

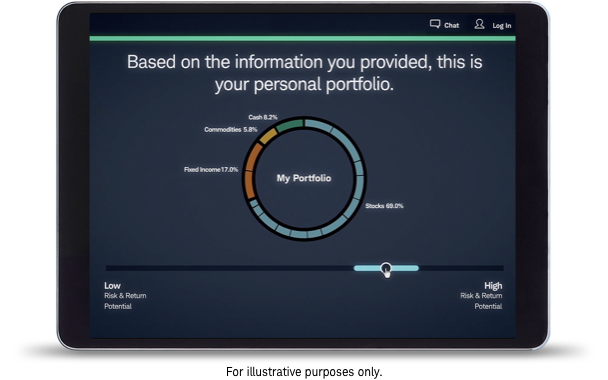

When it comes to retirement planning, two of the most prominent brokerage firms—Charles Schwab and Fidelity—offer a wealth of tools and services. Both companies allow you to open a variety of retirement accounts, such as Traditional IRAs, Roth IRAs, and 401(k)s. However, their retirement planning tools, fees, and features differ in important ways. Retirement Accounts Both Schwab and Fidelity offer no-fee accounts for traditional and Roth IRAs, making them appealing for retirement investors. Fidelity stands out with its extensive selection of low-cost target-date funds, which automatically adjust the asset allocation as you get closer to retirement. Schwab also offers target-date funds, but they’re not as widely recognized as Fidelity’s. Retirement Planning Tools Fidelity offers robust retirement planning tools that allow you to estimate your future retirement income and assess your current savings trajectory. Their tools provide personalized recommendations based on your financial goals. Schwab’s retirement planning tools are similarly helpful, providing detailed retirement projections. They also offer in-person meetings with certified financial planners, which can be a great option for investors who want more personalized advice. Robo-Advisor Services Both Schwab and Fidelity offer robo-advisor services for retirement savings. Schwab’s Intelligent Portfolios have no advisory fee and require a minimum balance of $5,000. Fidelity’s Go service also has no advisory fee, but it requires a slightly higher minimum balance of $5,000. Conclusion Both Schwab and Fidelity offer excellent options for retirement planning, with Schwab standing out for its personalized financial planning services and Fidelity excelling in retirement-specific fund options and tools. Ultimately, the right choice will depend on your retirement goals and preferences.

Tools and Resources: How Charles Schwab and Fidelity Stack Up

When it comes to investing, the tools you use can make a significant difference in your experience and outcomes. Charles Schwab and Fidelity both offer excellent trading platforms and resources, but how do they compare? Trading Platforms Schwab’s StreetSmart Edge platform is one of its most popular tools for active traders. It offers customizable dashboards, advanced charting features, and real-time data to help investors make quick, informed decisions. The platform also includes backtesting capabilities and access to a wide range of research reports. Fidelity’s Active Trader Pro platform is designed for more experienced traders and offers similar functionality. You can customize your workspace with real-time quotes, advanced charting, and access to streaming news. Fidelity also has a strong mobile app, ensuring that traders can manage their investments while on the go. Research and Educational Tools Both Schwab and Fidelity offer a wealth of research and educational tools to help investors stay informed. Schwab provides robust stock research tools, including Morningstar reports and Schwab’s own analysis. They also have a vast library of educational content, including blogs, video tutorials, and articles aimed at beginner and intermediate investors. Fidelity’s research offerings are equally strong. They offer tools such as Fidelity Research & Insights, which includes proprietary reports on individual stocks, as well as analyst ratings and third-party research. Their educational resources include live webinars, articles, and investment guides, all designed to help investors build their knowledge. Customer Support and Assistance Both Schwab and Fidelity offer strong customer support options, including 24/7 phone assistance, live chat, and a variety of online resources. Schwab is particularly known for its helpful customer service and user-friendly interface, while Fidelity excels in its financial planning tools, making it an ideal choice for investors seeking long-term support. Conclusion While both companies offer excellent tools for traders and investors, Schwab’s StreetSmart Edge and Fidelity’s Active Trader Pro are designed for different types of users. Schwab’s platform is more user-friendly, while Fidelity’s platform offers greater customization for experienced traders. Both companies also offer strong research tools and educational resources, making them both solid choices for investors.

Comparison of Fees and Services: Charles Schwab vs. Fidelity

When it comes to managing your investment portfolio, understanding the fee structures of different brokerage firms is crucial. Both Charles Schwab and Fidelity are top contenders, offering competitive fees, comprehensive services, and an array of tools designed to meet the needs of a wide variety of investors. Let’s take a closer look at how their fee structures compare and how they affect your investments. Trading Fees Both Charles Schwab and Fidelity have eliminated commissions on online stock and ETF trades, which means you can buy and sell without worrying about paying a fee for each transaction. This puts both companies ahead of many other firms that still charge commissions. However, when it comes to options trading, Schwab charges $0.65 per contract, whereas Fidelity charges $0.65 per contract as well. These fees are on par with most competitors, so there’s no significant difference here. Mutual Fund Fees One area where Schwab and Fidelity differ is in their mutual fund offerings. Schwab offers over 4,000 no-transaction-fee mutual funds, which include a variety of funds that can fit the needs of most investors. Fidelity’s mutual fund offerings are similarly strong, offering over 3,500 no-transaction-fee mutual funds, but they also have a wider selection of their own funds that come without trading fees. If you’re looking for a broad selection of fund options, both companies have you covered. Account Fees Neither Charles Schwab nor Fidelity charges an account maintenance fee, so you won’t have to worry about paying a recurring fee just to keep your account active. Both also provide low-cost IRAs and no-fee robo-advisor services. Schwab’s Intelligent Portfolios and Fidelity’s Go service both offer robo-advisory services that require a minimum of $5,000. Other Fees In addition to their core fees, both Schwab and Fidelity charge fees for services like broker-assisted trades, wire transfers, and account transfers. Schwab’s fee for broker-assisted trades is lower than Fidelity’s, while both firms charge similar fees for wire transfers. Conclusion Both Charles Schwab and Fidelity offer fee structures that make them attractive choices for different types of investors. With zero commission trades for stocks and ETFs and robust mutual fund options, both companies provide an excellent value. The choice will ultimately come down to the services you prefer and how much you want to invest in other offerings such as advisory services or specialty funds.

Charles Schwab vs. Fidelity: An In-Depth Comparison of Investment Services

When it comes to choosing an investment firm, Charles Schwab and Fidelity are two of the most popular options available to investors. Both companies offer a range of services, tools, and benefits designed to meet the needs of individual investors. But how do they compare in key areas such as investment services, fees, tools, and benefits? Investment Services Both Charles Schwab and Fidelity provide an array of investment services, including brokerage accounts, retirement accounts, and financial advisory services. Schwab offers a wide variety of asset classes, including stocks, bonds, ETFs, mutual funds, and options. They also provide access to a broad selection of international markets. Fidelity is similarly well-equipped, with a diverse range of investments and global market access. In terms of account types, both Schwab and Fidelity provide traditional brokerage accounts, Roth and Traditional IRAs, 401(k) accounts, and college savings plans. Schwab stands out with its client-friendly approach to margin trading, while Fidelity is known for its robust research offerings. Fees and Commissions When it comes to fees and commissions, both Schwab and Fidelity are highly competitive. Neither charges an account maintenance fee, and both offer commission-free online trades for stocks and ETFs. However, there are differences when it comes to other services. Schwab offers free trades on most mutual funds but may charge a fee for more specialized or actively managed funds. Fidelity, on the other hand, also offers free trades on most mutual funds, and they have a significant advantage in offering commission-free trades for over 3,000 of their own mutual funds. Both companies have no fees for account opening, closing, or inactivity, but Schwab does offer slightly lower fees on broker-assisted trades than Fidelity. Tools and Resources Charles Schwab is well-known for its comprehensive set of online tools, including an intuitive mobile app, extensive research reports, and educational resources. Schwab’s proprietary trading platform, StreetSmart Edge, offers advanced charting features and technical analysis, making it a good choice for active traders. Fidelity also offers a robust platform with strong research and analysis tools. Their Active Trader Pro platform is user-friendly and customizable, making it a favorite for experienced traders. Fidelity also boasts a vast library of articles, webinars, and tools for investors looking to improve their financial literacy. Benefits and Customer Service Both companies offer stellar customer service with 24/7 phone support, and both Schwab and Fidelity have physical branches where clients can access in-person assistance. Schwab’s Schwab Live Chat feature and in-depth help articles are also valuable for quick troubleshooting. Fidelity has an edge when it comes to retirement planning services, with its automatic rebalancing tools and specialized retirement savings plans. Schwab, on the other hand, offers a range of comprehensive advisory services, with personalized recommendations from financial planners. Conclusion Ultimately, choosing between Charles Schwab and Fidelity depends on your investment needs and preferences. Schwab is excellent for active traders and those who need a wealth of tools for research and trading. Fidelity, however, might be the better choice for those focused on retirement planning or seeking an intuitive, beginner-friendly experience.